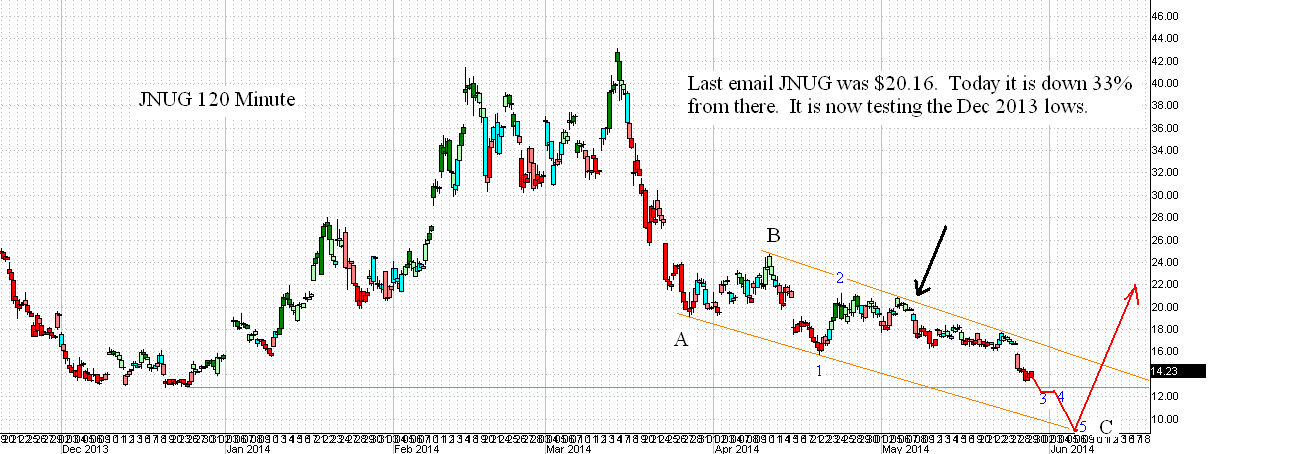

In addition, the Junior miners ETF (GDXJ) just broke below its June 2013 low. IMO that spells both near term trouble and major opportunity. The high level model has now changed to the one below. The implication here is that we are not working on an ending diagonal but rather a large 4th wave triangle. The bottom rail should be either horizontal or perhaps downward sloping a bit as shown below. The reason I chose that downward slope for the model is that it is the line drawn through the declining double bottom circled near blue 2. These lines have been quite accurate of late in predicting the future direction of the chart. Having said that, I would go on high alert bottom watch if the GDXJ chart hits about $28 which is where a horizontal line drawn from blue 2 would take us.

If this chart plays out then it will smash JNUG and it will bash the junior minors even more than they already are. I could represent a good short term trade, especially on JNUG. If GDXJ nearly doubles on the bounce, JNUG will nearly quadruple. I'm keeping a nice pile of cash on the sideline hoping this model plays out.

No comments:

Post a Comment