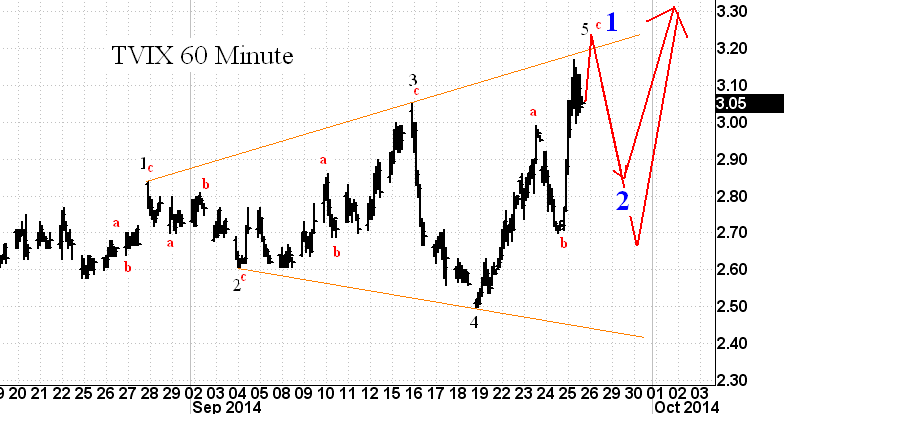

If you match Wed to Wed and Thurs to Thurs above and below you will see that the blue model above was followed nicely. So what's next?

Well, today's peak could have been either:

- 1 of 3

- 3 of 1 of 3

- C of 5 of an expanding wedge that is starting a new bull market.

If it is 1 of 3, the chart will likely pull back to the 50% fib ($2.93) for a short time before skyrocketing with shock and awe into 3 of 3. You would want to be part of that move as it could be 17-22% in one fell swoop.

If it is 3 of 1 of 3 then it simply means that 1 of 3 did not finish yet and that the bouncing around is the formation of wave 4. I think this is quite likely and it is what I will be looking for tomorrow AM. If the 4th wave finishes normally, throws under and then moves 5 waves up into 5 then I am out of this ticker until the pullback happens (or a higher high proves my count wrong.

Now, in every scenario there is generally some kind of implied threat and in this one it is that this is the 5th wave of a large expanding wedge that is wave 1. I am a bit concerned about this because expanding wedges can have big swings on the retracement. So if this finishes 4 of C and then moves up to break out of the top rail then set your stops just below the rail because if it subsequently comes pounding back down through it will be looking to get a lot of the recent gains back. That worst case scenario is why I will bail out if I see a 4th wave play out and then a small 5th to kiss the top rail or throw it over. The pullback could either be to the prior 4th before rocketing higher or it could be much lower (see blue model above and red models below) before really beginning the big move up.

Once we are past this expanding wedge hurdle of uncertainty, look for massive TVIX gains as the broader markets begin to turn the herd from bullish and proud (anyone see Kramer make an ass of himself last night about the 170 point DJIA rally?) into scared and panicking. FEAR HAS BEEN TOO LONG FROM THESE MARKETS and fear is now making a comeback.

No comments:

Post a Comment